🇪🇬 Egypt on a roll

So far 2021 has been a bumper year for Egypt when it comes entrepreneurship. In January Egyptian EdTech startup Ahkdar raised a seed round from EdVentures. We featured ecommerce player Expandcart’s growth story in our February issue.

In March, venture capital firm Sawari Ventures announced it had closed a $71 million fund for investment in startups across Egypt and the Maghreb. Then in April Egyptian laundry app, Laverie, raised a 6-figure funding round from investment firm A15.

Fast forward to this month and things seem to be hotting up even more. At the beginning of May Egyptian logistics startup Flextock raised $3.25 million in pre-seed funding to scale across the MENA region.

This week, Egyptian e-commerce startup Homzmart raised $15m Series A funding and fintech startup Telda raised $5 million in a pre-seed round. Telda’s round was led by Sequoia.

Thus far Sequoia have taken a taciturn approach when it comes to investing on the African continent. With one of their partner’s being South African we hope that this investment in North Africa will be a harbinger for many more across all of the African sub-regions.

Getting an investment from Sequoia is not like any investment. As one of the largest VC’s in the world it comes with a certain “je ne sais quoi” that can help create a legacy for a company, town, city or even region. Silicon valley was practically built on the wealth of Sequoia and a handful of other Sandhill Road VC’s such as Andreessen Horowitz and Kleiner Perkins. Onwards and upwards!

Multiple rounds in a year

Most startups typically look to raise a round of funding every 12-24 months or whenever it looks like their “runway” will end. Some startups buck this trend and will raise multiple rounds within a year.

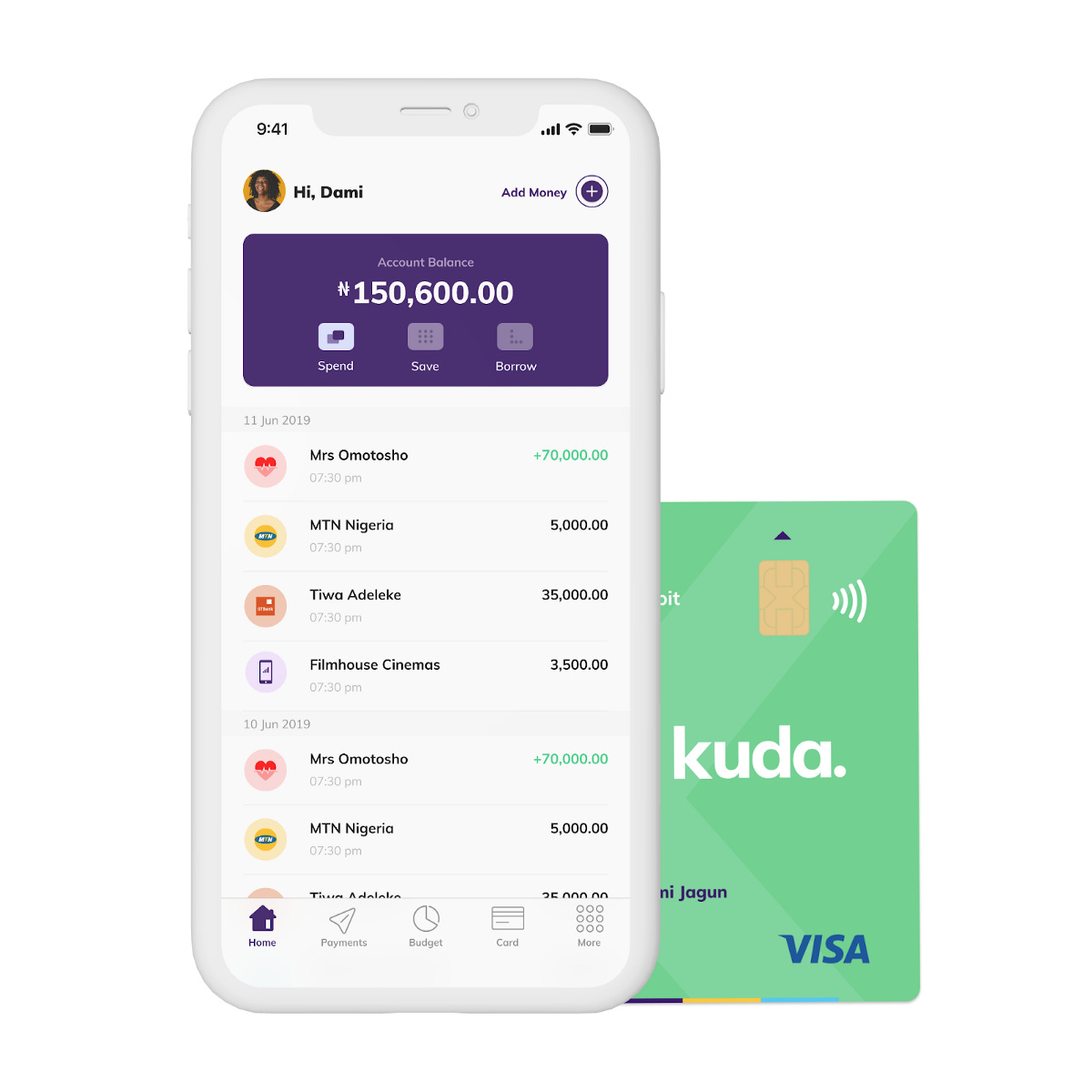

A case in point is Nigeria’s Kuda Bank which raised two rounds in the space of only 5 months. In November 2020 they raised a $10 million seed round and then in March this year they raised a $25 million Series A.

For many startups like Kuda this is often a sign of hockey stick growth which requires added capital to effectively resource the surge in new users as well as fund the marketing efforts to sustain such growth.

In Kuda’s case, for their most recent round, they were approached by Valar Ventures. Kuda felt this was an opportunity they couldn’t let slip by. With the likes of Transferwise (now rebranded to Wise) and Xero in the Valar stable, we can see why Kuda welcomed Valar onto their cap table.

Optimising retail spaces

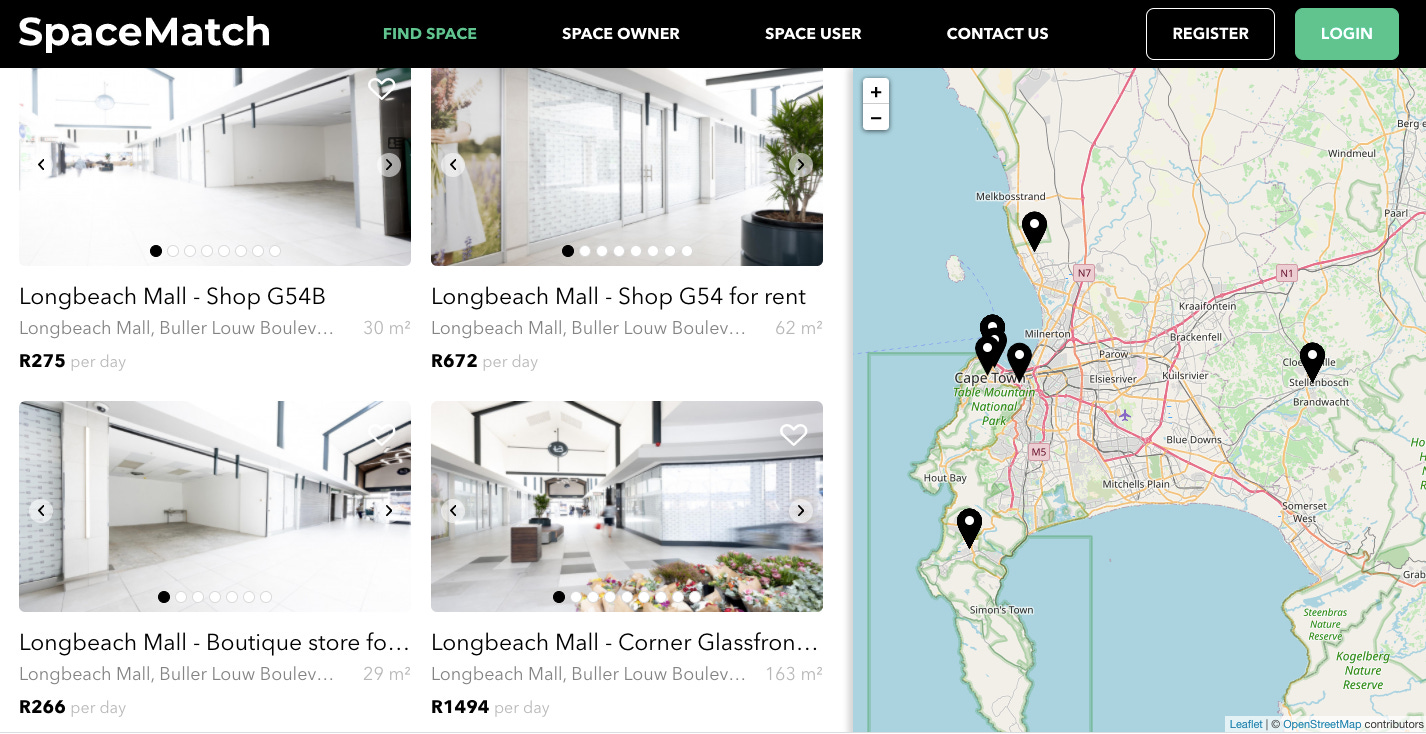

The pandemic has created a rather turbulent environment for many retailers, particularly those without the backing of larger consortia. In spite of the rent reductions commercial property landlords have offered to their tenants, many retailers have had to close their doors.

This has resulted in a supply glut in recent months. Next time you’re in a shopping precinct, be it a mall or high street, take a look around and notice the number of vacant premises.

A South African startup has recently launched to help solve this very issue. SpaceMatch connect vacant commercial property with tenants looking to rent on both a monthly or daily basis. The beauty of the free market!

In the News 🚀

🇳🇬 Nigerian ethical credit startup BFree raised an $800k seed round to help it scale across the sub-region.

🇪🇬 Another Egyptian startup raising capital this month. This time it’s courier company Bosta who has raised a $6.7 million Series A funding round to help it expand operations across the Middle East.

🇰🇪 Kenya’s largest telecoms company, Safaricom, is in talks with Amazon to integrate M-PESA, an online payment solution ubiquitous across East Africa.

🇳🇬 A Nigerian startup bill is currently being discussed between founder, investors and key government stakeholders.