Francophone Africa's first unicorn

Investment into African fintech continues unabated. This time it’s into a fintech category that was once a forerunner, but in recent years has tapered off in favour of peer-to-peer lending, neo banking and payment platforms. We’re talking about mobile money.

Wave, a Senegalese mobile money provider, has recently become Francophone Africa’s first unicorn (valued at more than $1 billion) and the fifth unicorn across the entire continent. The other four being Interswitch, Fawry, Flutterwave, and Jumia. All of these are fintech’s apart from Jumia which is an e-commerce player.

Wave managed to secure a $200 million Series A from Founders Fund, Sequoia Heritage (a subsidiary of Sequoia), Stripe, and Ribbit Capital at a valuation of $1.7 billion. Smaller participants in the round included Partech Africa and Sam Altman, former CEO of Y Combinator.

Wave is looking to disrupt an industry category which has long been dominated by telco-owned incumbents. The most notable being M-Pesa which was launched in 2007 by Vodafone and Kenyan mobile operator, Safaricom. Owning the mobile networks gave these companies a moat which thwarted any attempts from new upstarts to gain market share. This hegemony however has resulted in innovation stagnation.

With the mobile money market in sub-Saharan Africa growing exponentially year-on-year and with Africa’s unbanked majority, the addressable market opportunity is colossal. According to the IMF, only 43% of adults in sub-Saharan Africa are “banked” by way of a traditional bank or mobile money account. It’s no wonder all the big names came to the funding party on this one.

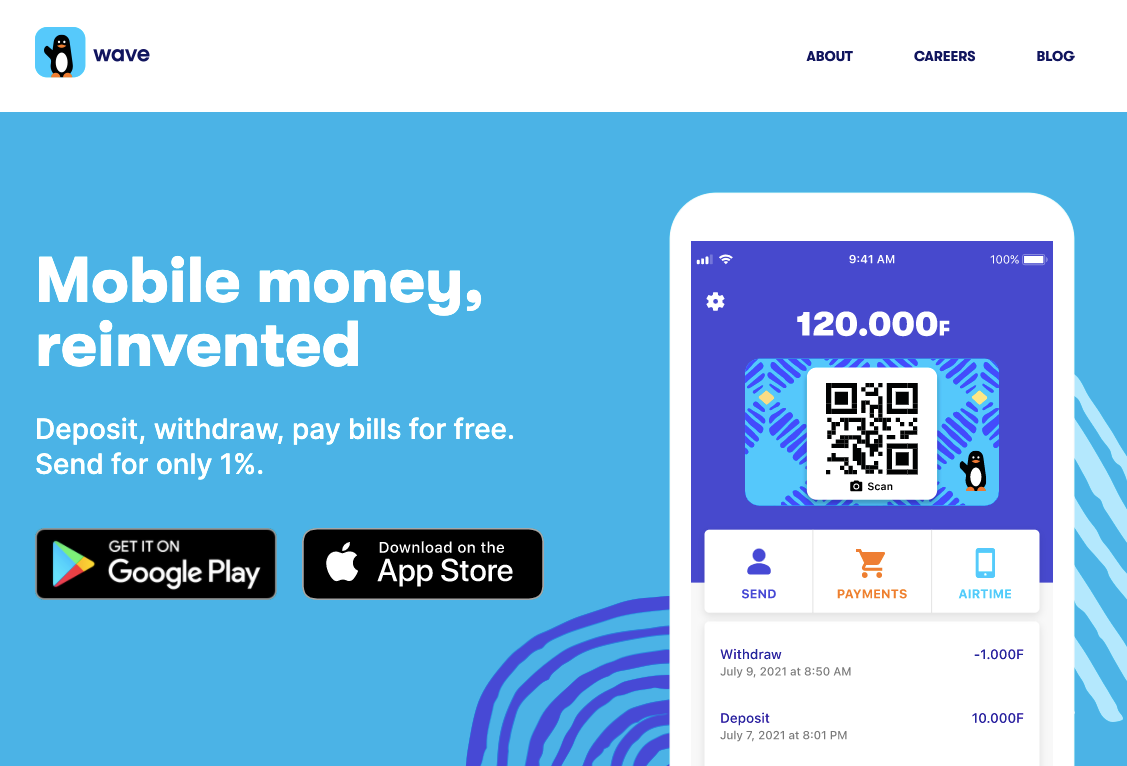

Wave is planning to improve the mobile money user experience by offering free deposits and withdrawals and only charging 1% when you send money - 70% less than what it currently costs according to their founder Drew Durbin.

They’re also working on Mobile Money 2.0 which is app-based rather than being built on USSD - essentially the communication protocol for sending text messages. For users without a smartphone, Wave provides a free QR-card to transact with an agent.

With a full-stack tech infrastructure - agent and consumer applications, an agent network, QR cards, business collections and disbursements - Wave has been able to accelerate its traction now boasting several million monthly active users and billions of dollars in annual transactions.

With this additional $200 million in its coffers Wave plans to grow out its 800 strong team across sales, product and engineering and also deepen it roots in Senegal and the Ivory Coast, its two main markets. From there it will look to expand to regulatory-friendly markets across the continent and eventually take on the likes of M-Pesa.

In the news 🚀

🇳🇬 Nigerian spices exporter Agricorp has raised a $17.5m Series A funding round to help it increase its production capacity to 7,000 metric tonnes.

🇪🇬 Egyptian e-commerce startup, FwRun, has been acquired by Saudi Arabian last mile delivery and logistics firm Diggipacks.

🇺🇬 Ugandan e-logistics startup Ridelink has raised a $150K pre-seed round to enable further expansion in the region.

🇰🇪 Kenyan fintech startup Pezesha, has closed a seven-figure seed extension round as it looks to expand into new markets.